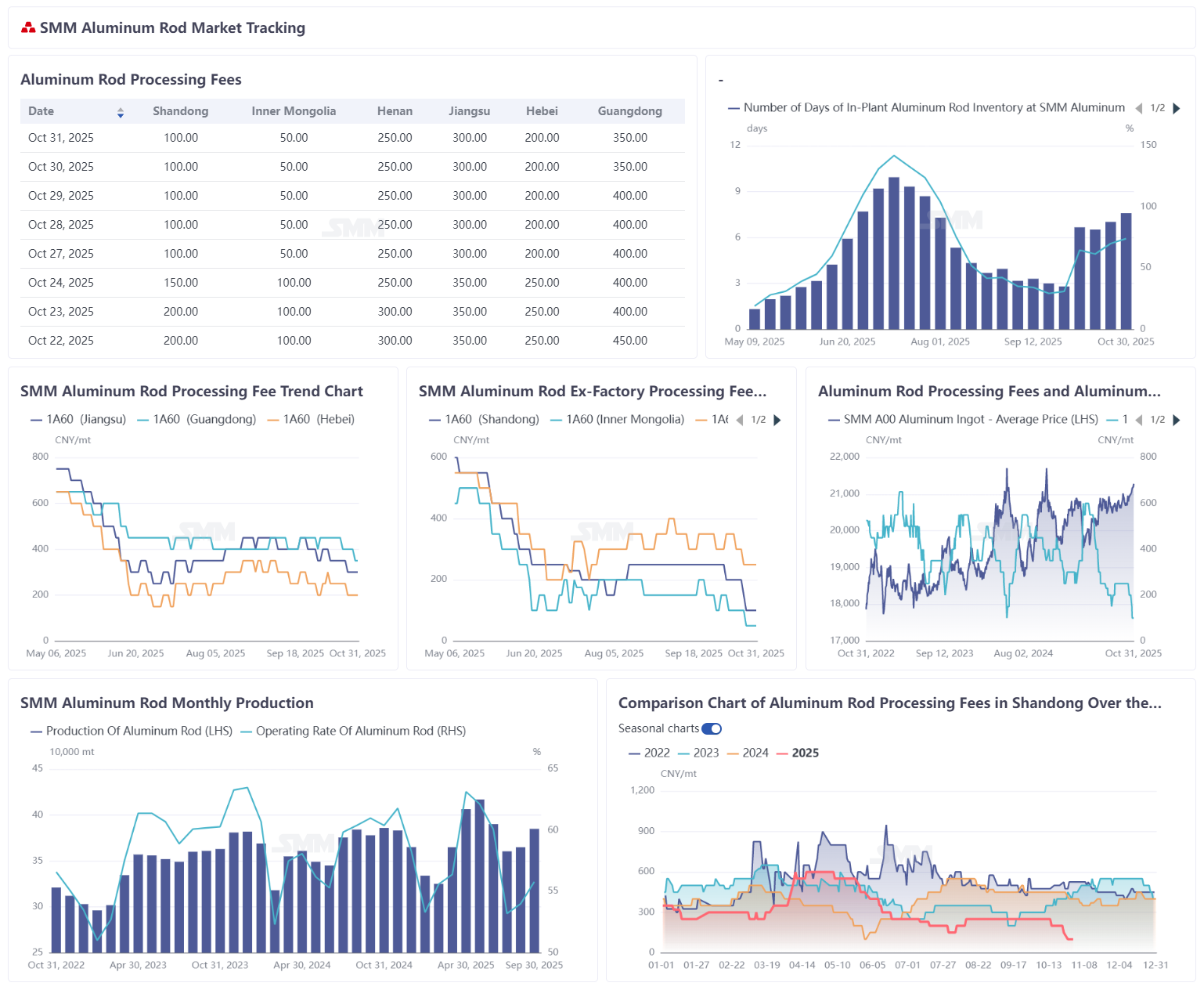

According to SMM statistics, as of October 31, 2025, the domestic days of inventories at aluminum rod plants were 7.6 days, an increase of 0.57 days WoW. Aluminum rod inventory continued to show a buildup trend, and the market oversupply situation saw no significant improvement. In terms of inventory ratio, the domestic in-factory inventory ratio for aluminum rod plants recorded 74.12%, up 4.04% WoW, and the pressure from inventory accumulation remained unrelieved.

Driven by macro sentiment, SHFE aluminum prices hit a new yearly high this week and maintained a fluctuating trend at high levels, continuously suppressing aluminum rod processing fees. Meanwhile, the persistent buildup of aluminum rod inventory and a relatively loose market supply kept processing fees hovering at low levels under dual pressures, making it difficult for them to rise. As of October 31, 2025, by region, aluminum rod processing fees in Jiangsu were quoted at 250-350 yuan/mt, in Hebei at 150-250 yuan/mt, and in South China at 300-400 yuan/mt. Looking at aluminum rod processing fees by region, Shandong offered 50-150 yuan/mt, Inner Mongolia offered 0-100 yuan/mt, and Henan offered 200-300 yuan/mt. Besides the impact of high prices and ample inventory, weak end-use demand was also a key factor in the aluminum rod market's sluggish performance. Downstream operating enthusiasm was severely limited, with procurement mostly focused on driving down prices. Coupled with fragmented demand, warehouse withdrawals for aluminum rods were very challenging. In some regions, self pick-up prices even showed "negative processing fees" to promote transactions, undoubtedly worsening the situation for aluminum rod enterprises.

This week, the aluminum wire and cable industry's weekly operating rate fell 1 percentage point WoW to 63.4%. Affected by environmental protection-driven production restrictions in Henan, plant operating rates declined by the end of October. Additionally, overall industry shipments contracted, and feedback from end-use sectors like the power grid and PV was pessimistic, compounded by persistently high aluminum prices dampening manufacturers' enthusiasm for finished product production. From an enterprise operation perspective, capacity utilization was basically flat, but shipments contracted. In terms of industry orders, although orders from State Grid tenders showed continuity, slower cargo pick-up pace by end-users constrained order fulfillment. Looking ahead to next week, due to factors like shipment pressure, high aluminum price pressure, and weak end-user pick-up—which are unlikely to improve in the short term—the operating rate is expected to maintain a narrow, rangebound fluctuating trend. Continuous attention is needed on price trends and the connection with scattered end-user orders, as well as the lifting timeline for environmental protection-driven production restrictions in Henan. SMM Brief: The domestic aluminum rod market is currently experiencing a significant oversupply, with high inventory, low prices, and weak demand—these "three major challenges" continue to squeeze the profit margins of aluminum rod producers. On the demand side, downstream users are affected by aluminum prices fluctuating at highs, which hinders the transmission of cost pressure; short-term improvement is expected to be weak. If aluminum prices continue to hover at highs, corporate liquidity pressure will gradually become more prominent, further forcing aluminum rod plants to proactively reduce capacity. In that case, phased production cuts within the industry would fall within expectations. SMM expects that aluminum rod processing fees will remain under pressure in the short term, with no clear signs of improvement for now.